Chart of Accounts

The chart of accounts in SAP (COA) is a group of general ledger (G/L) accounts that records the organizational transactions in a structured way. Each general ledger account consists account number, name and control information.

there are 3 types of chart of accounts

1, group chart of accounts

2, country chart of accounts

3, operating chart of accounts

There are 4 ways to create Chart of accounts :-

1.Chart of Accounts - TCode - OB13

2.Assign Company Code To Chart Of Accounts - TCode- OB62

3.Define Account Groups- TC- OBD4

4.Define Retained Earnings Account - TCode- OB53

1, define chart of accounts - Tcode OB13

Search OB13 - then enter

you can see

this 👇

now fill in basic fields as per the company

chart of accounts

description

language

length of gl account

controlling intregation

then save

2, Assign Company Code To Chart Of Accounts - TCode- OB62

search bar - ob62

then enter

click on position, write your company code

then write your chart of accounts name

👇

then save

3, Define Account Groups- TC- OBD4

All the General Ledger accounts of the organization are classified

in to different groups for the easy and convenient management of GL accounts.

These are called the account groups.

search bar - obd4 - enter

SELECT - NEW ENTRIES

write your

1, company code

2, accounts group like - asset, liabilities , expense, revenue, and income

3 create range for a particular group but should not be overlap

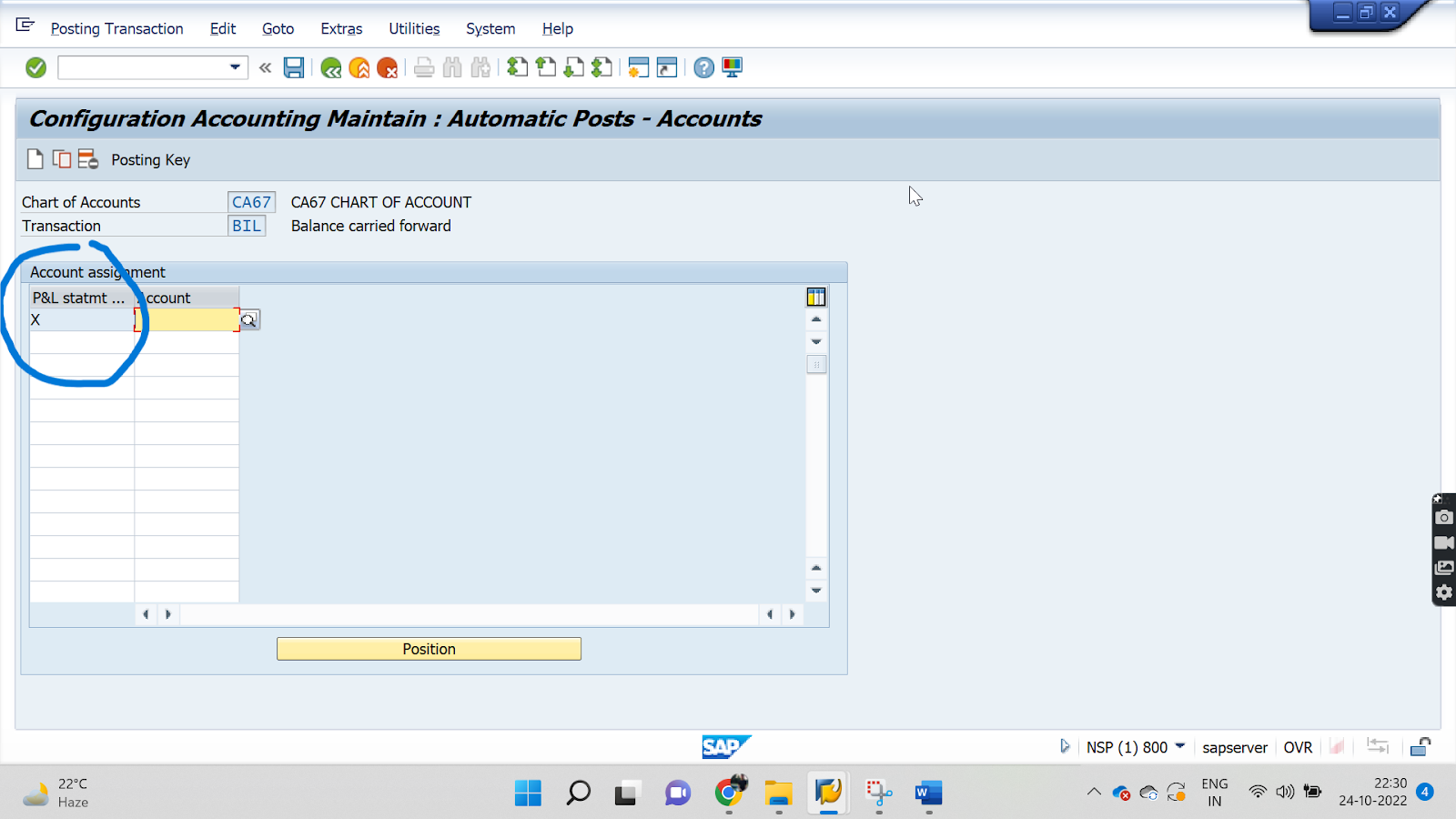

4,.Define Retained Earnings Account - TCode- OB53

At the end of every fiscal Year balance of Income Statement (Profit

or Loss) gets transferred to Retained Earning Accounts.

write on search bar - ob53

then write your company code name -

write ( X ) in the profit and loss statement column and do not fill any accounts in the account column ( if you mention any account then only that account transaction transfer previous year to next year )

Hope this blog is helpful to you

If you want to see my SAP FICO training videos in the Hindi language

Click on this 👉-- https://youtu.be/-pji2cSbm4w

Comments

Post a Comment