SAP Tolerance Groups - define posting authorizations of users in SAP ERP system. These posting permissions define the amounts that certain groups of accounting clerks are allowed to post. SAP Tolerance Groups determine various amount limits for employees and predefine the maximum amount an employee is permitted to post, the maximum amount the employee can post as line items in a customer or a vendor account, the maximum cash discount percentage the employee can assign in a line item, and the maximum allowed tolerance for payment differences for the employee.

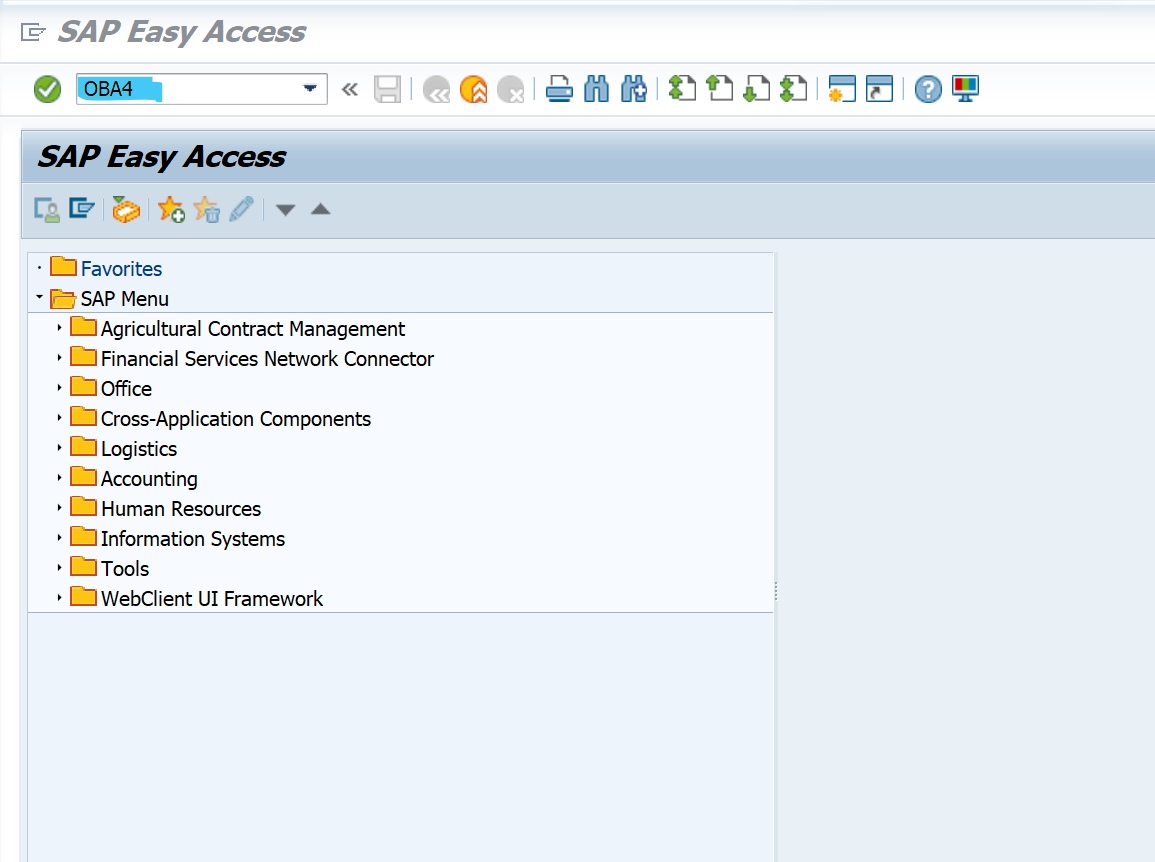

Define Tolerance Groups For Employees -TC - OBA4STEP 3 - FILL REQUIRED INFORMATION BUT DON'T WRITE ( GROUP COLUMN ) BECAUSE NO ONE IS ASSIGNING YOU THE TOLERANCE LIMIT.

Hope this blog is helpful to you

If you want to see my SAP FICO training videos in the Hindi language

Click on this 👉-- https://youtu.be/NatnGnYGlus

Comments

Post a Comment